Finances Goals 2025

- Apply to 365 usability studies

- I applied for ~332 studies

- Make $2500 in side income, including study gift cards and cash

- Nailed it! From bank and credit card signup bonuses to selling things around the house and all the studies in between!

- Complete 4 mystery shops

- I completed 2 Bestmark shops in December because they were too good to pass up, but otherwise, I didn’t prioritize completing shops

- Spend less than I make

- Though I did make the money I spent earn as much as it could for me, I didn’t manage to meet this goal

Financial Accomplishments of 2025:

- I completed 22 studies and participated in 2 Reedsy Discovery book review challenges

- I earned just over $1000 from studies last year paid out in gift cards, credits, checks, and cash

- I’ve saved $139.42 on Too Good To Go for the year ($76.58 spent) with 14 bags (the app that lets you rescue unsold food at your favorite spots from an untimely fate and is typically 1/3 the cost of the retail value) $930 saved lifetime since 2022

- I earned $154.74 from browser extension Rakuten and $48 from receipt uploading (as gift cards)

- I earned 2 bank bonuses and got 2 credit card SUBs this year

- I got $325 in value from freebies (including my yearly birthday rewards, Amazon First Read books, Alamo level-ups, AMC investor connects, and Yelp Elite events)

- I snagged several phone upgrades through T-Mobile with their 24-month credits (iPhone 17 Pro Max for $263 after trade in, iPhone 17 Air for $94 after trade in, and an iPhone 17 free upgrade with trade in)

- I earned and spent ~$1480 in credit card rewards and have points worth ~$3600 that I’m saving for future travel

- I fully funded my Roth IRA for the year

Finances Goals 2026: no specifics this year

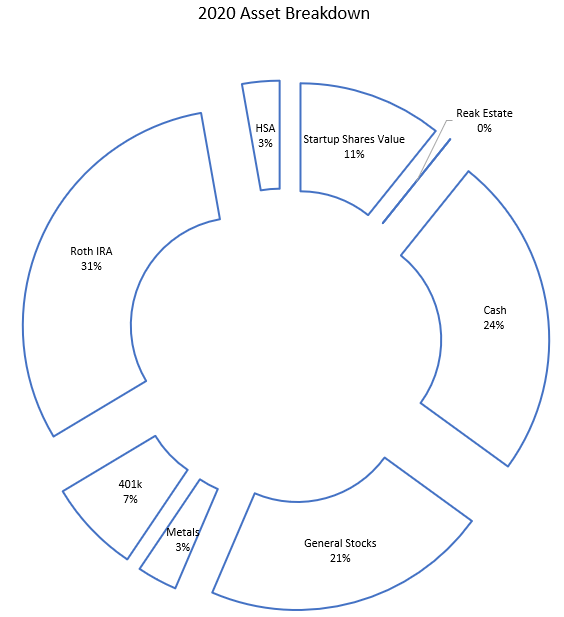

Let’s take a look at my assets (and net worth) and how they’ve changed over time:

| Asset | 2025 % of value | 2024 % of value | 2023 % of value | 2022 % of value | 2021 % of value | 2020 % of value | 2019 % of value |

| Stock Shares | 18% | 18% | 18% | 13% | 10% | 11% | 16% |

| Real Estate | 24% | 32% | 40% | 49% | 41% | 0% | 0% |

| Cash | 1% | 4% | 4% | 4% | 8% | 24% | 16% |

| General Stocks | 5% | 4% | 3% | 3% | 4% | 21% | 23% |

| Precious Metals | 3% | 2% | 2% | 2% | 2% | 3% | 4% |

| 401k | 6% | 5% | 4% | 4% | 6% | 7% | 8% |

| Roth IRA | 38% | 30% | 23% | 20% | 25% | 31% | 32% |

| HSA | 5% | 5% | 5% | 5% | 4% | 3% | 0% |

| Total net value | 0% increase | 2.6% increase | 18.5% increase | 16% increase | 76% increase | 53% increase |

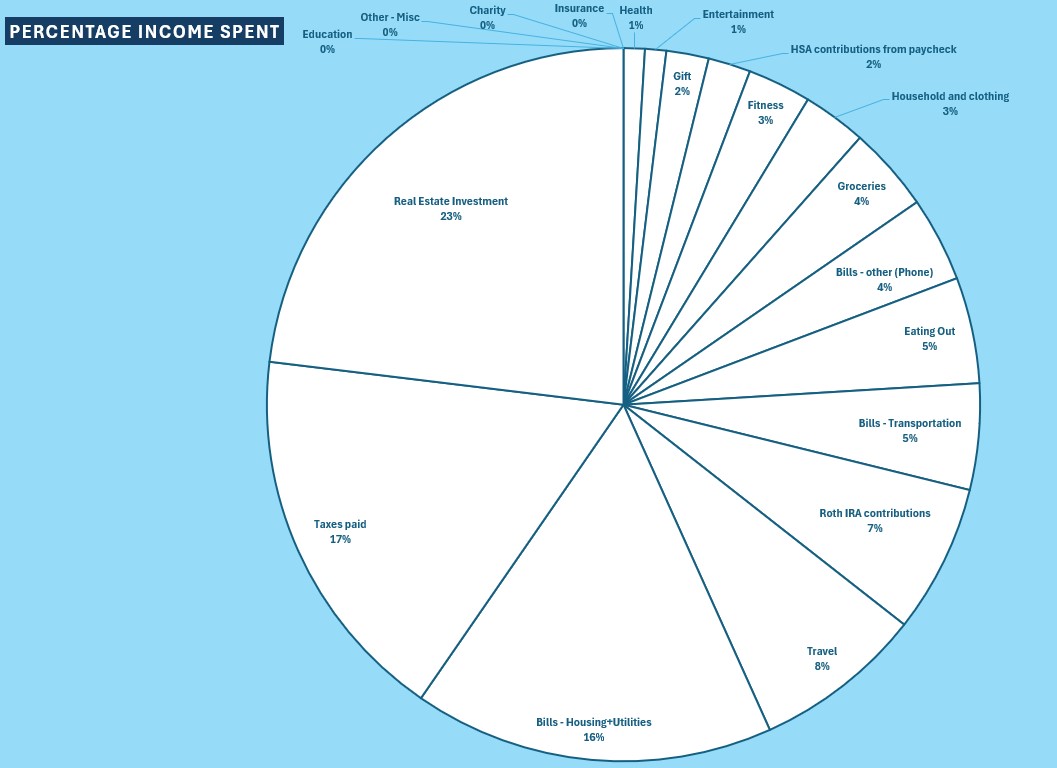

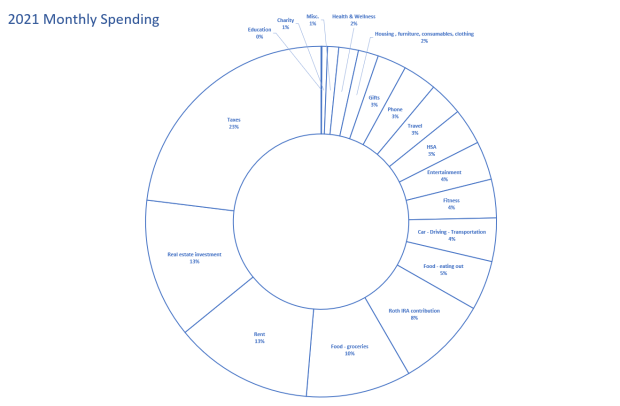

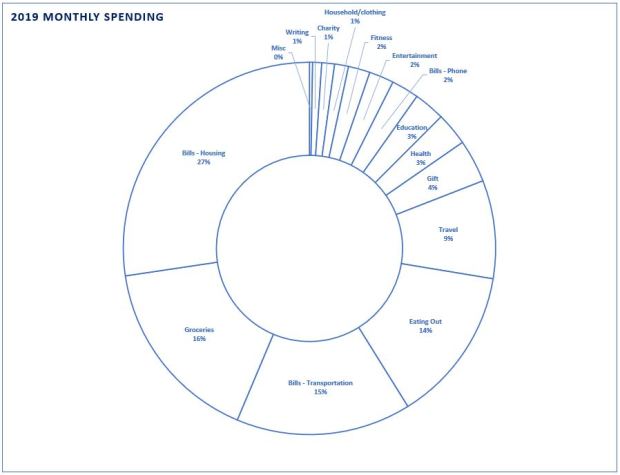

I look at how much I adhered to my monthly budgeting over the year and compare it to previous years’ spending:

| 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 | |

| Education | na | 2% | 0% | 0% | 0% | 0% | <1% | <1% |

| Other – Misc | 2% | 0% | 3% | 1% | 3% | 2% | <1% | 1% |

| Charity | na | 1% | 1% | 1% | 0% | 0% | <1% | <1% |

| Insurance | na | na | na | na | na | na | <1% | 4% |

| Health | 27% | 2% | 4% | 2% | 1% | 1% | 1% | 1% |

| Entertainment | 2% | 1% | 1% | 1% | 2% | 3% | 1% | 1% |

| Gift | na | 2% | 4% | 3% | 0% | 1% | 2% | 1% |

| HSA contributions from paycheck | 5% | na | na | 4% | 2% | 2% | 2% | 0% |

| Fitness | 1% | 1% | 1% | 4% | 2% | 2% | 3% | 1% |

| Household and clothing | 3% | 1% | 4% | 2% | 10% | 4% | 3% | 3% |

| Groceries | 7% | 10% | 11% | 10% | 6% | 5% | 4% | 4% |

| Bills – other (Phone) | 3% | 1% | 4% | 3% | 3% | 4% | 4% | 3% |

| Eating Out | 4% | 8% | 3% | 5% | 4% | 3% | 5% | 4% |

| Bills – Transportation | 7% | 9% | 7% | 4% | 3% | 5% | 5% | 4% |

| Roth IRA contributions | 9% | 12% | 12% | 9% | 6% | 7% | 7% | 6% |

| Travel | 2% | 5% | 5% | 3% | 11% | 13% | 8% | 17% |

| Bills – Housing+Utilities | 9% | 17% | 17% | 14% | 16% | 15% | 17% | 13% |

| Taxes paid | 19% | 28% | 25% | 22% | 18% | 19% | 18% | 17% |

| Real Estate Investment | na | na | na | 12% | 13% | 18% | 24% | 20% |